January 25, 2019

This graph says more than it seems:

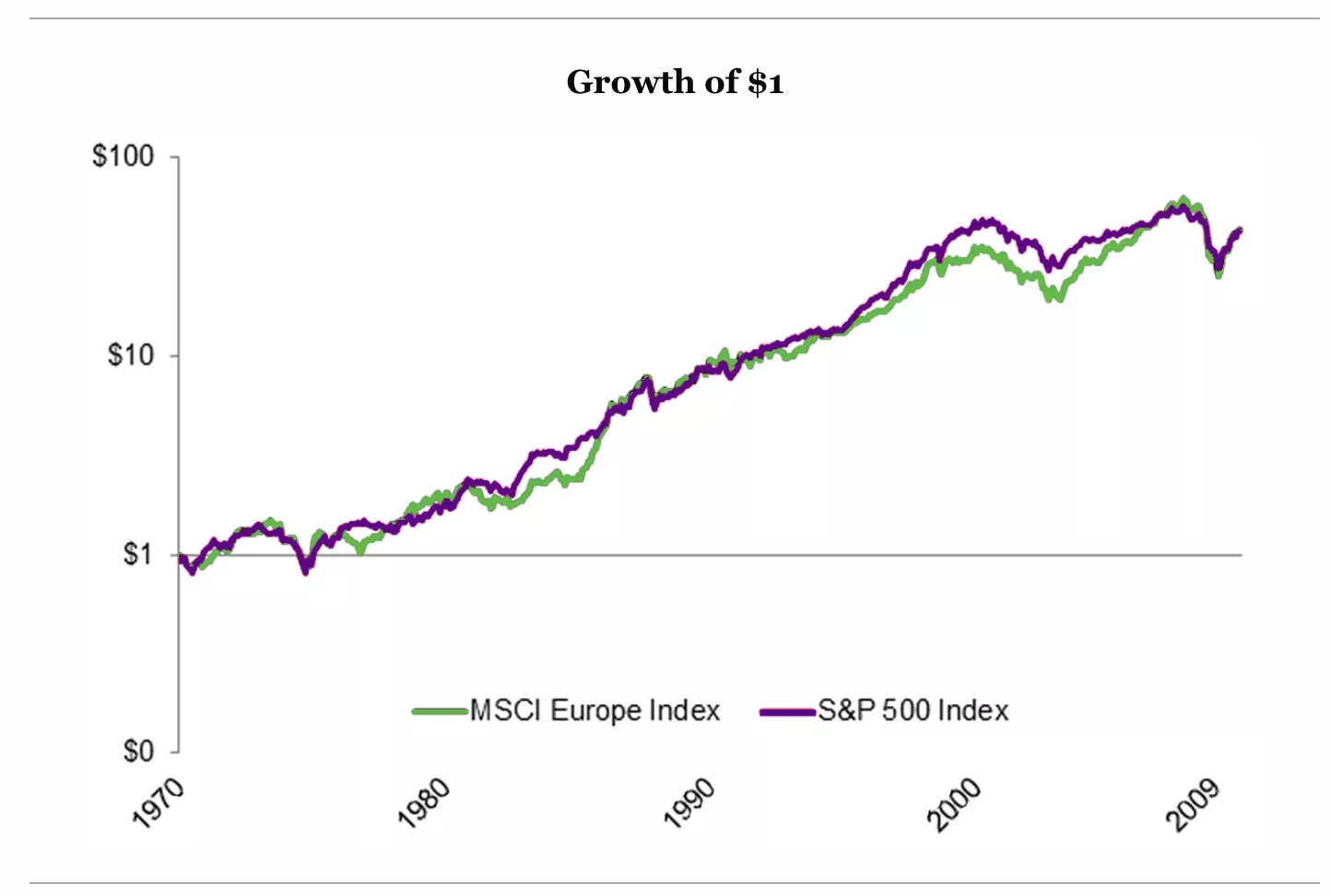

From 1970 through 2009, the performance of large European and large American corporations has been almost exactly the same. Actually, Europe beat us, at 9.88% vs 9.87%. (But we got John Lennon, so there.)

Note that the graph is logarithmic, so that divergence periods are large in percentage terms. And note that these divergence periods go on for long periods of time: 5 to 10 years. Not shown on this graph: currently we are in an extended stretch where American returns have exceeded those in Europe.

There are endless debates over who runs a better economic system: the U.S. or Europe. The United States has a labor market that is freer and more fluid. European CEOs' lower salaries leave more profit for investors. America has a better bankruptcy system to clean up non-performing assets, European workers get more vacation and are happier.

But over a 39 year period, it's fascinating that the two market systems had equivalent returns. Keep in mind that in any given year, the returns could diverge by 10% or more. And there have been several multi-year periods in that 39 years where the divergence exceeded 150%.

There is a gem at work here. Differing markets across geography or asset classes not only revert to their mean returns but also display the tendency to divert from that mean substantially at times. A good investment model should be able to use that to capture advantage both in returns and risk diversification.

That is a core underpinning idea of what we focus on at One Day In July.

Dan Cunningham

Sources: German CEO Compensation Fortune 4/4/14, CFA Institute 4/28/17