July 2, 2025

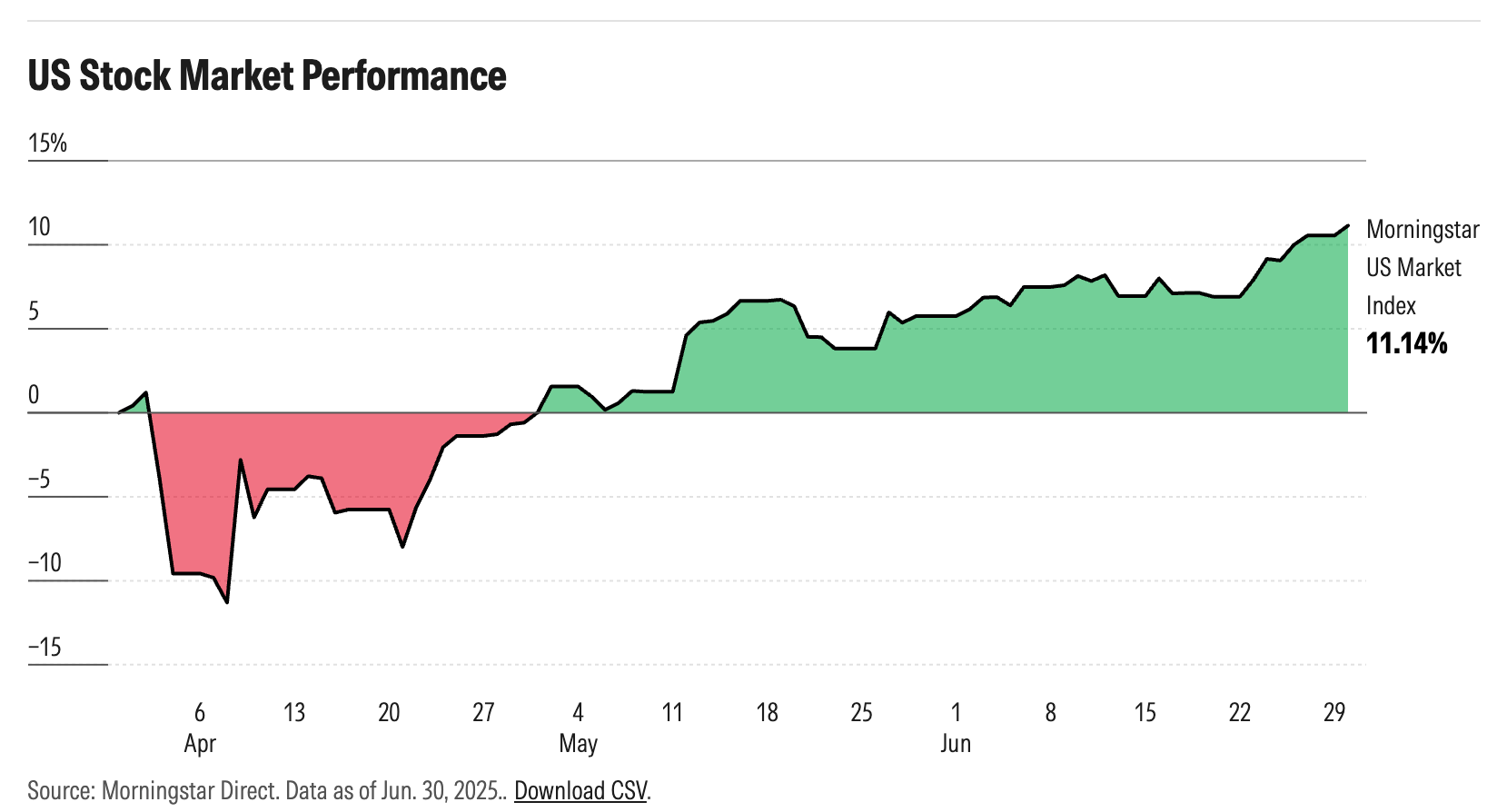

The S&P closed at a new all-time high to wrap up 2Q 2025. This was welcome news to investors after equity markets dropped 11.5% during the first week of April alone with concerns of looming tariffs. Markets quickly rebounded as tariffs were either paused or reduced headed into May.

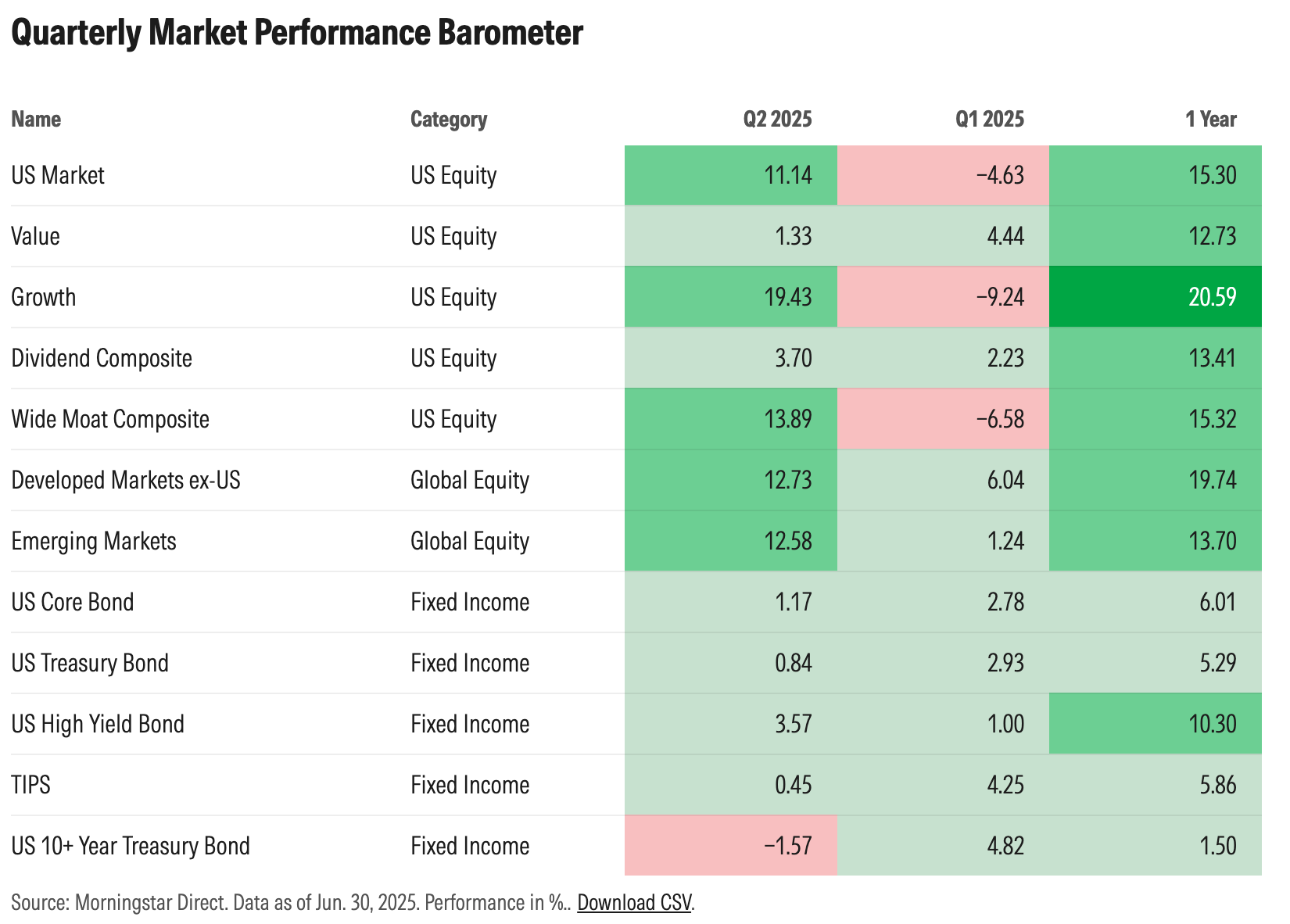

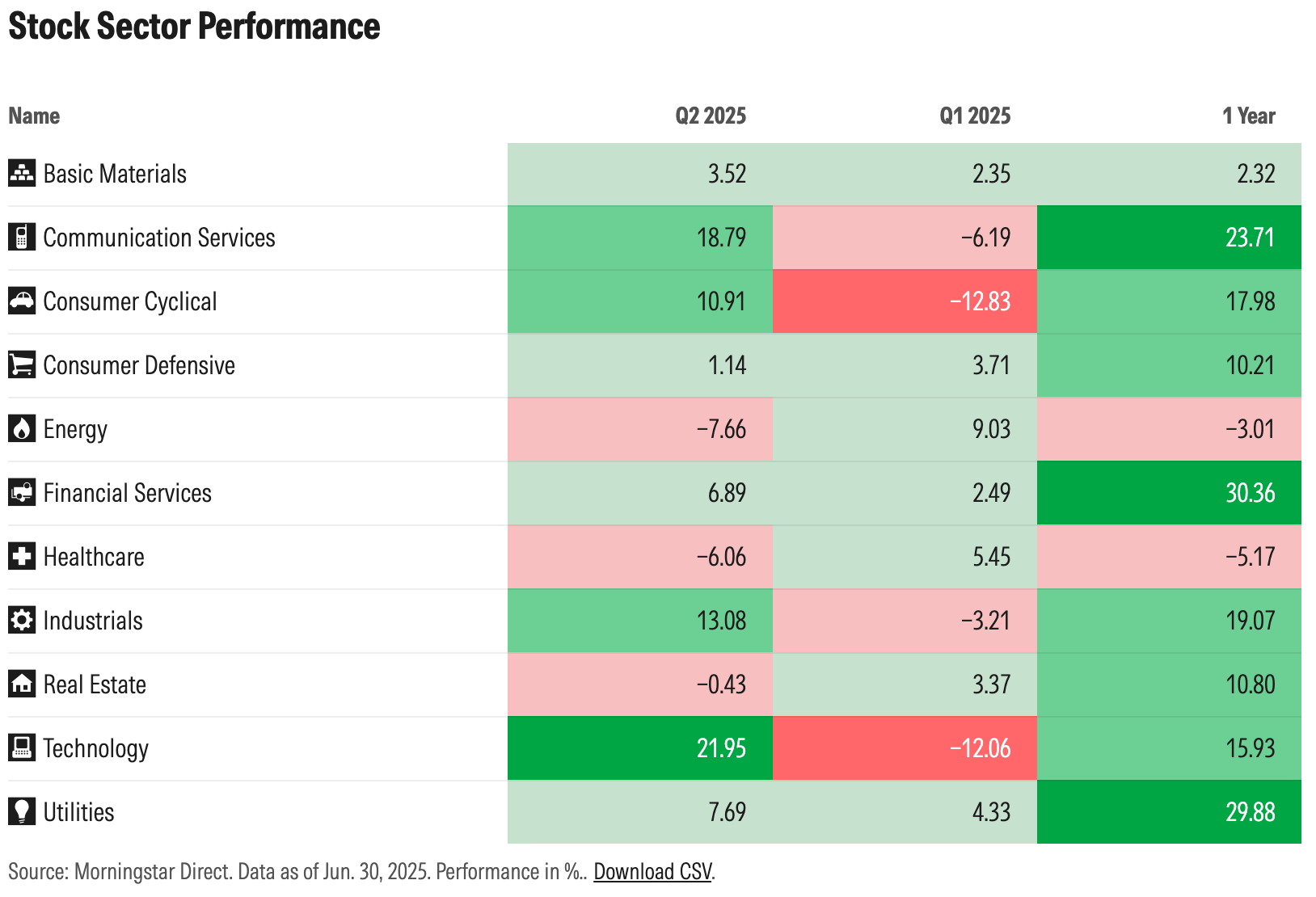

US Growth stocks were up 19.43% in Q2 2025 driving overall market performance following tough Q1 as tariff concerns faded. International markets have outperformed this year stringing together two positive quarters despite the geopolitical concerns. Bond markets held steady as interest rates have fluctuated between fiscal concerns about the US deficit and economic concerns related to tariffs. The US 10-Year yield ended Q2 2025 down 33 basis points (0.33%) year-to-date helping drive positive total return for the bond market.

Taking a break from markets and other top headlines for a moment. I wanted to touch on a topic that has been popping up on a more micro level. Some interesting and concerning data collected related to the rising delinquencies in student loan repayments.

During the pandemic, payments on federal student loans were paused. This pause lasted almost 4 years and resumed in late 2023. Loan repayments were to start in October 2023, with a 12-month easement to start the payments (called an “on ramp”). While interest would accrue for these loans, debtors who missed monthly payments during this period were not considered delinquent or reported to credit bureaus.

That “on-ramp” expired in October 2024, and some troubling data started to quickly trickle in during the first quarter of 2025.

Per the U.S. Department of Education, “there could be almost 10 million borrowers in default in a few months. When this happens, almost 25 percent of the federal student loan portfolio will be in default.”

Is 10 Million borrowers a lot? Yes, it is.

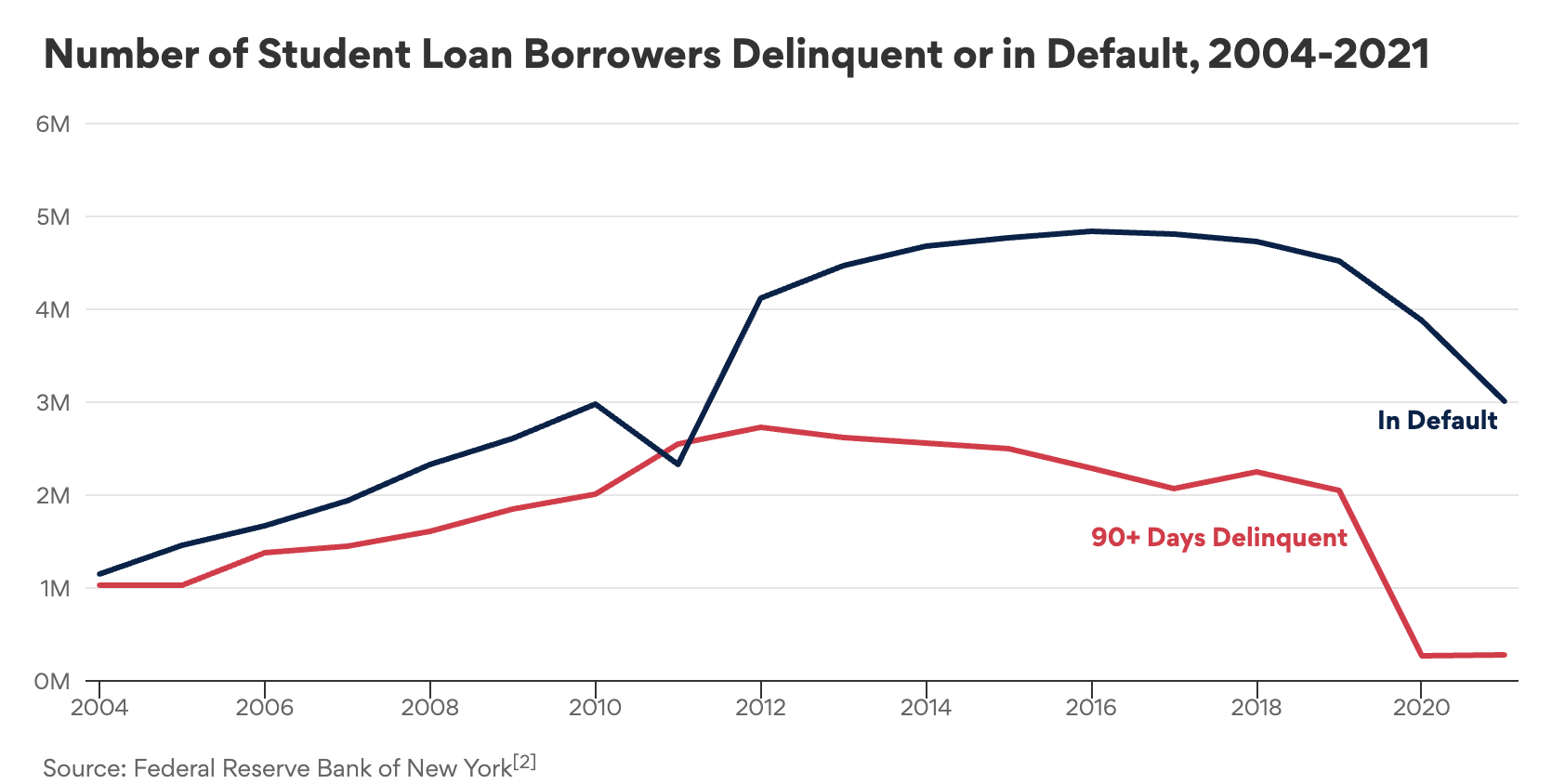

Per the Federal Bank of New York, below you can see that the number of student loan borrowers in delinquency had not surpassed 5M in the past 20 years.

Per Best Colleges, “in the last decade, the student loan default rate ranged from a high of 11.8% in 2012 to a low of 7.3% in 2018. That’s a massive drop from prior years."

Best Colleges: Student Loan Default Rate: Facts and Statistics

A new analysis by TransUnion found that as of April, 31% of student loan borrowers with a payment due are in “late-stage delinquency,” or over 90 days past due on payments. That’s the highest share the credit bureau has ever recorded. (Note: they have been recording this data since 2012.)

What’s next…. As reported in the Wall Street Journal last week, nearly 2 million borrowers are at risk to have their pay docked as soon as this summer. Federal student loan borrowers in default can face wage garnishment, where the government can take up to 15% of their disposable pay to recover the debt through automatic deductions from their paychecks. This can happen without a court order after the loan has been in default for more than 270 days.

This recent data concerns me on a few fronts:

It will be interesting (and a little scary) to see what happens in the coming months and years. Hopefully this may drive some thoughtful change in how families and students approach funding their higher education.

As always, please reach out with any questions.

- Nancy Westbrook