April 3, 2025

After much anticipation, “Liberation Day” arrived clarifying plans for a range of tariffs to be implemented on imports. These “reciprocal” tariffs have a baseline of 10% on all countries except Canada and Mexico. Most major trading partners have an additional tariff that equals half the ratio of the bilateral trade deficit with the country divided by US imports from that country. This means the tariffs are based on the trade imbalance with each country, not actual levies applied to US products. While this announcement provided some degree of clarity, it is important to know that plans may evolve as negotiations and responses from countries take place in coming weeks. Regardless, higher tariffs will be in place, and this will lead to heightened uncertainty over how these tariffs will impact our economy. There is risk of higher prices for consumers, a slowdown in business activity, and potential job losses, leading to a higher probability of a recession.

Markets hate uncertainty. The volatility driven by these uncertainties creates more discomfort for investors already nervous about our political climate, international relations, and our overall economy. I understand and appreciate the level of concern that exists for many.

Vanguard released a statement last night “cautioning investors against tactical portfolio changes” which is a sentiment shared by One Day In July. They continue to note that it would be “imprudent to attempt to identify specific investment implications immediately following the announcement. Financial markets may respond quickly to developments as they unfold in the near term, but we caution long-term investors against reacting with tactical or short-term changes to well-considered investment plans .”

Investor discipline in volatile times is critical. Important reminders to help navigate market volatility:

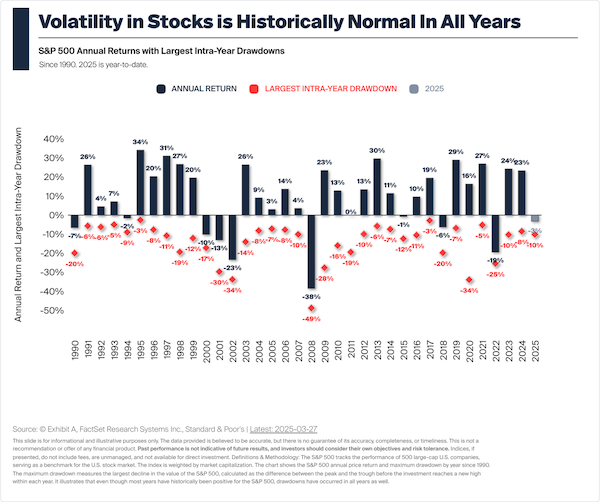

I found the following chart to be helpful when trying to keep a historical perspective. Market drawdowns are commonplace and to be expected when invested for the long term. There have been many since 1990, but if you stayed invested in the S&P over these 30+ years, you would have had an average yearly return of around 10.7% (assuming reinvested dividends) and a 30-year return of 3,555.51%!

(Source: https://www.officialdata.org/us/stocks/s-p-500/1990)

(Source: https://awealthofcommonsense.com/

JP Morgan Private Bank released an interesting article this week. Its conclusion highlights the reassuring return of ‘negative correlation’ that was missing in our most recent 2022 downturn. As many of you may remember, we had a period of decline in equity markets coinciding with accelerated interest rate hikes. This caused simultaneous disruption in both bond and equity markets. As we enter this new phase of uncertainty, interest rates are higher which should be a tailwind for bonds providing more defense and diversification to investors.

We entered 2025 after a 2-year run of 57.8% returns by the S&P – making for the largest 2-year gain in 26 years. The S&P 500 has corrected in late Q1 leading to its worst quarterly performance since Q3 2022 (-4.3%).

(Statistics and below chart source: https://www.nasdaq.com/articles/first-quarter-2025-review-outlook)

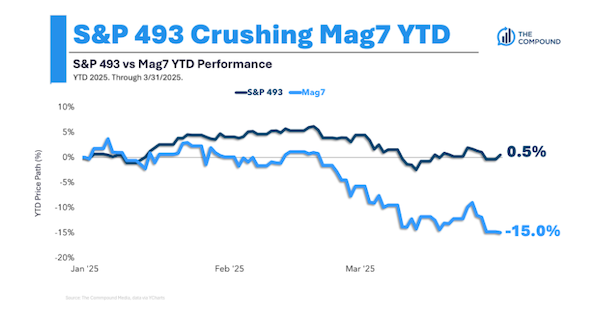

This decline was primarily driven by the Magnificent 7. Nvidia, for example started 2023 at a price of $14.85 and closed 2024 at $134.29 - or 804% higher. The stock declined 19.3% in Q1, and closed at 108.38, still 630% more that its trading price at the start of 2023. It is interesting to note that the S&P 493 (i.e., everything else) has remained flat YTD 2025.

(Source: https://awealthofcommonsense.com/)

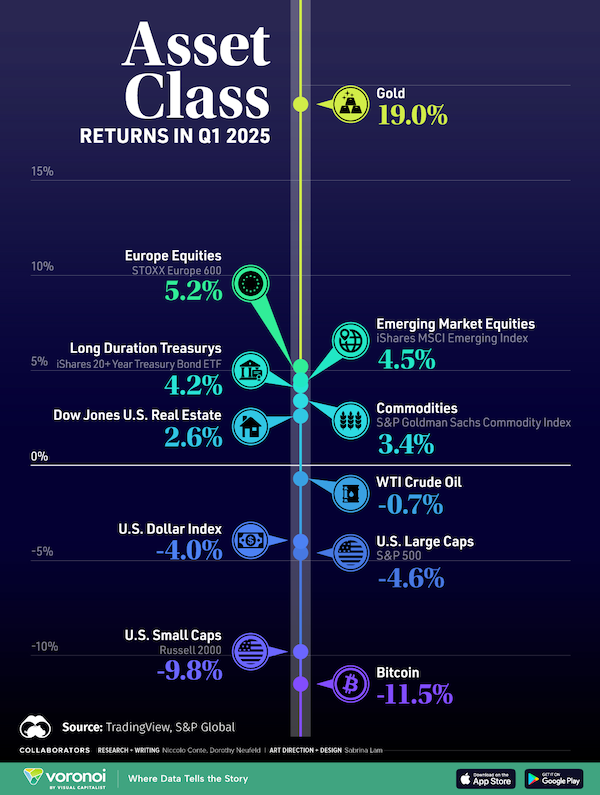

There is so much talk of the Magnificent 7 and the S&P, I think it is always helpful and interesting to get a sense of performance across broader asset classes as well. This certainly reinforces the value of diversification.

(Source: www.visualcapitalist.com)

As always, please reach out with any questions.

- Nancy Westbrook