October 7, 2025

Markets remain unphased by the government shutdown that began last week as we head into this final quarter of the year. Looking back, equity markets continued their rally in Q3 with all major indexes reaching record highs, stimulated by continued growth in the technology sector, and optimism around artificial intelligence. At its September meeting, the Fed delivered its first rate cut this year, bringing the target federal-funds rate to a range of 4.00%-4.25% (more on this later).

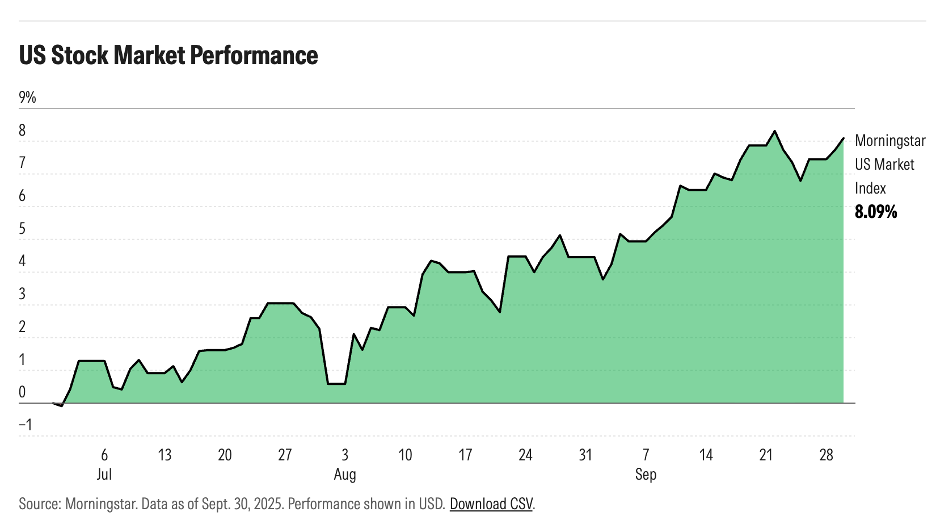

U.S. Market data is based on the Morningstar US Market Index which holds about 1,200 equities across large, mid, and small cap companies.

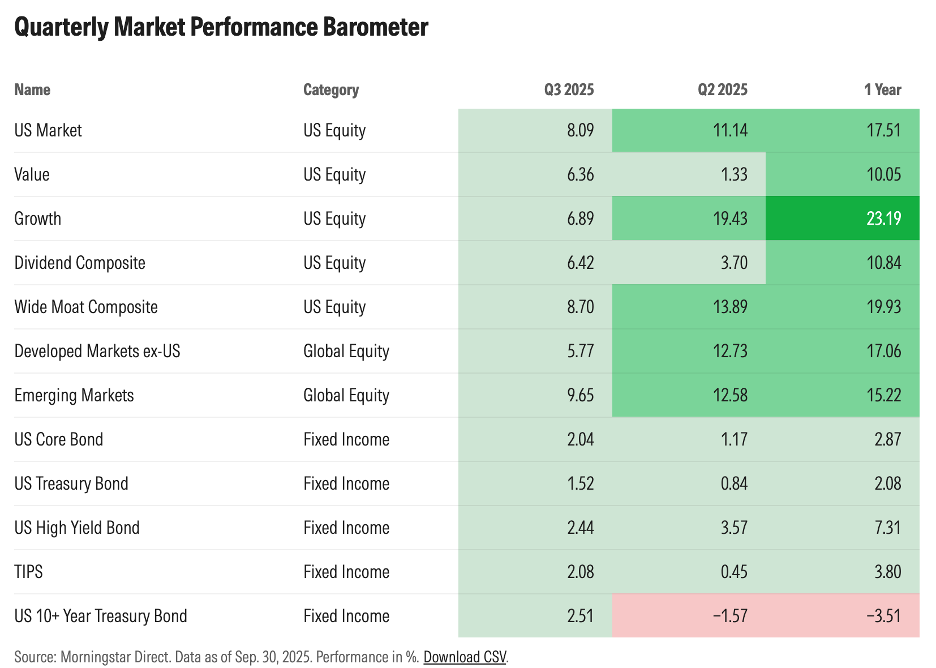

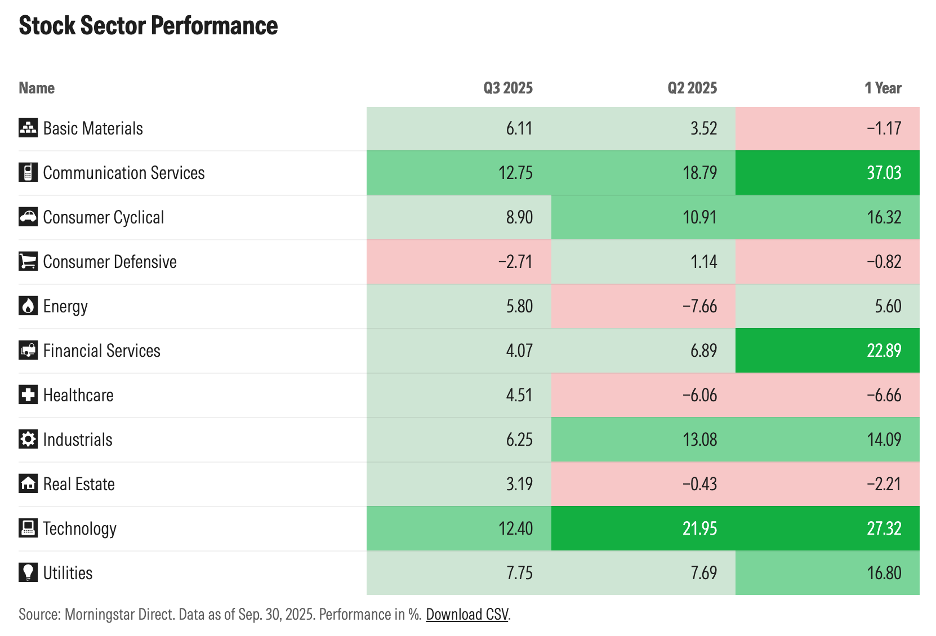

US Equity markets were up 8.09% for the quarter (Nasdaq besting that at 11.2% for Q3), and up 17.51% YTD. Growth continues to lead the way this past year with Communication Services and Technology both up over 12% in Q3 alone. Assisting this market momentum, S&P earnings in Q2 came in higher than expected with earnings growth of 11.7%, marking the third consecutive quarter of double-digit earnings growth. (Source: Morningstar.com)

I often get asked by clients, what do rate cuts mean for my portfolio?

Historically the stock market has performed well in rate cutting cycles, particularly higher growth technology related stocks. However, the economic backdrop at the time of the initial rate cuts is an important consideration. The current environment is marked by persistent inflation, a weakening labor market, and stretched stock market valuations. The practical implication of rate cuts on portfolios is that the yield on cash will be lower, which reinforces the need to stay fully invested.

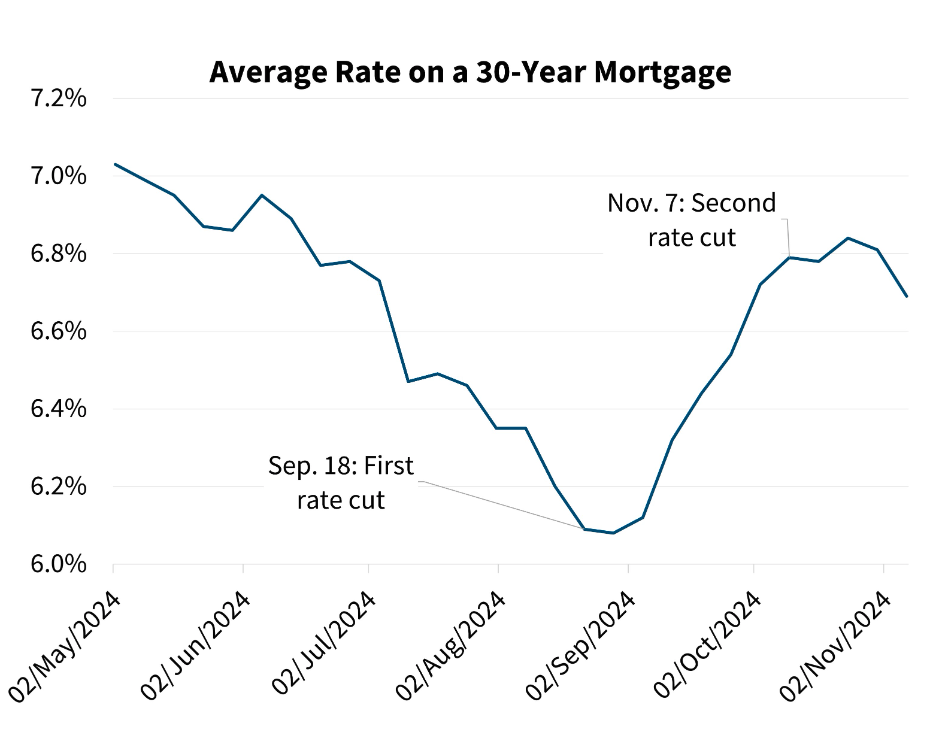

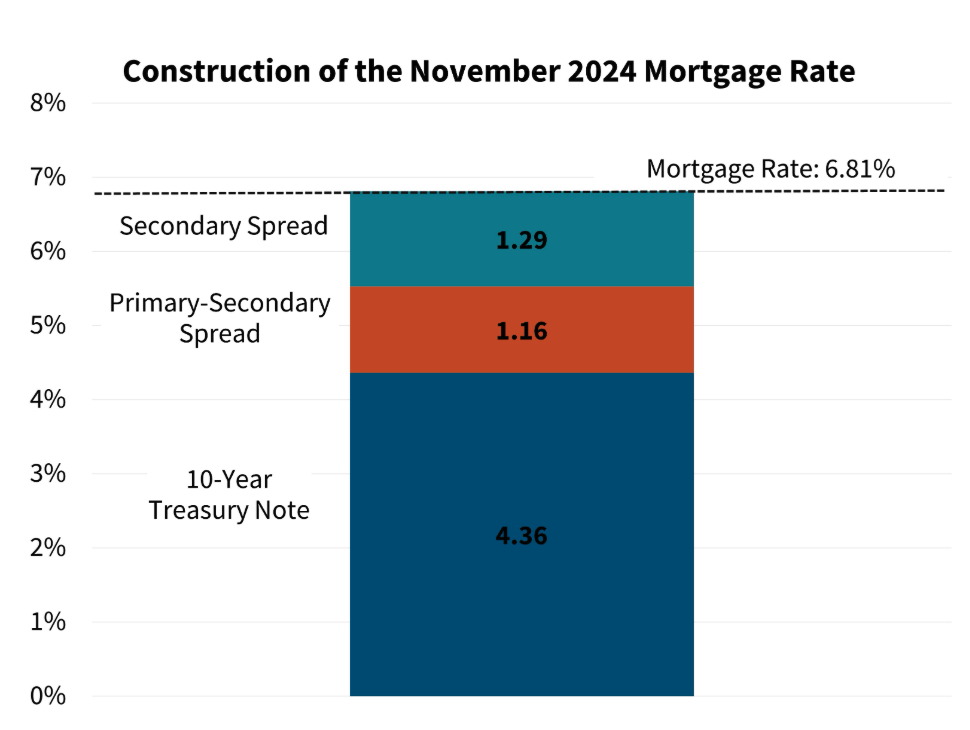

I am also asked why mortgage rates did not come down with this September rate cut. The chart below illustrates the 2024 rise in mortgage rates after last year's rate cut.

Source: Fanniemae.com

The federal funds rate is the interest rate at which banks lend money to one another overnight, meaning it's an interest rate on very short-term lending. Interest rates on other short-term bonds and loans move very closely with changes in the federal funds rate.

Mortgage rates are more closely tied to longer term interest rates such as the 10-year Treasury. This rate is determined in the bond market. With the 10-year Treasury, investors are looking at where short term lending rates are and factoring in expectations of how that may change over the life of a 10-year bond. Inflation and inflation expectations also play a large role in market pricing for 10-Year Treasury yields with higher levels of inflation implying higher interest rates. Expectations on future monetary and fiscal policy and economic growth are all factored in. Additionally, mortgage rates have spreads tacked on to that 10-year rate to reflect the added risks associated with lending and the added uncertainty of cash flows given that 30-Year Mortgages can be repaid early without penalty. All of this adds up to the conclusion that Federal Reserve policy rate changes do not translate directly to lower mortgage rates, and in fact investors may be concerned that the Fed cuts may spur inflation, push long term rates higher and result in higher borrowing costs for consumers.

Rate cuts might seem straightforward, but the story is more nuanced. Furthermore, their long-term implications may not align with initial market reactions. One Day In July's investment strategy is designed with these market complexities in mind, positioning portfolios to capture opportunities while maintaining resilience in changing conditions.

If you are interested in diving deeper into this topic, Fannie Mae published a good article: https://www.fanniemae.com/research-and-insights/publications/housing-insights/rate-30-year-mortgage

As always, please reach out with any questions.

- Nancy Westbrook